LTV vs. LTC: What’s the Difference and When Should You Use Each? A Visual Guide by Plethora Financial Solutions

LTV vs. LTC: What’s the Difference and When Should You Use Each?

What Is LTV? (Loan-to-Value)

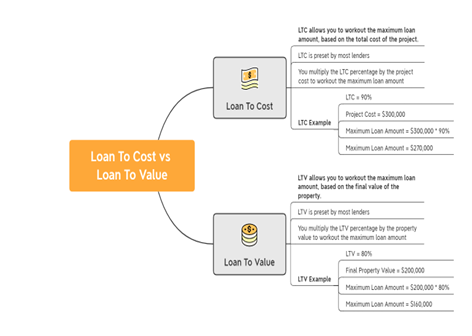

LTV = Loan Amount ÷ Appraised Property Value

📌 LTV Is Used For:

- 🏢 Purchasing stabilized commercial property

- 💼 Refinancing existing buildings

- 💰 Cash-out refinances

- 🏘️ Long-term rental and investment properties

👤 Best For Borrowers Who:

- Have properties with solid equity

- Need long-term financing

- Are not doing construction or heavy renovations

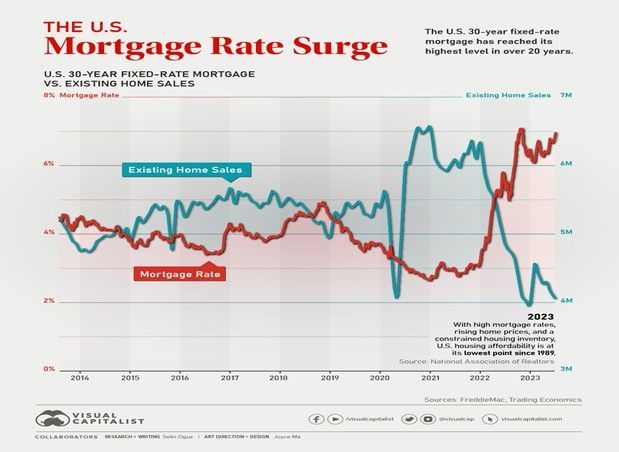

📈 Typical LTV Ranges:

- Commercial Real Estate: 65–80%

- Investment Properties: 70–80%

- Cash-Out Refi: 60–70%

🏗️ What Is LTC? (Loan-to-Cost)

LTC = Loan Amount ÷ Total Project Cost

📌 LTC Is Used For:

- 🧱 Ground-up construction

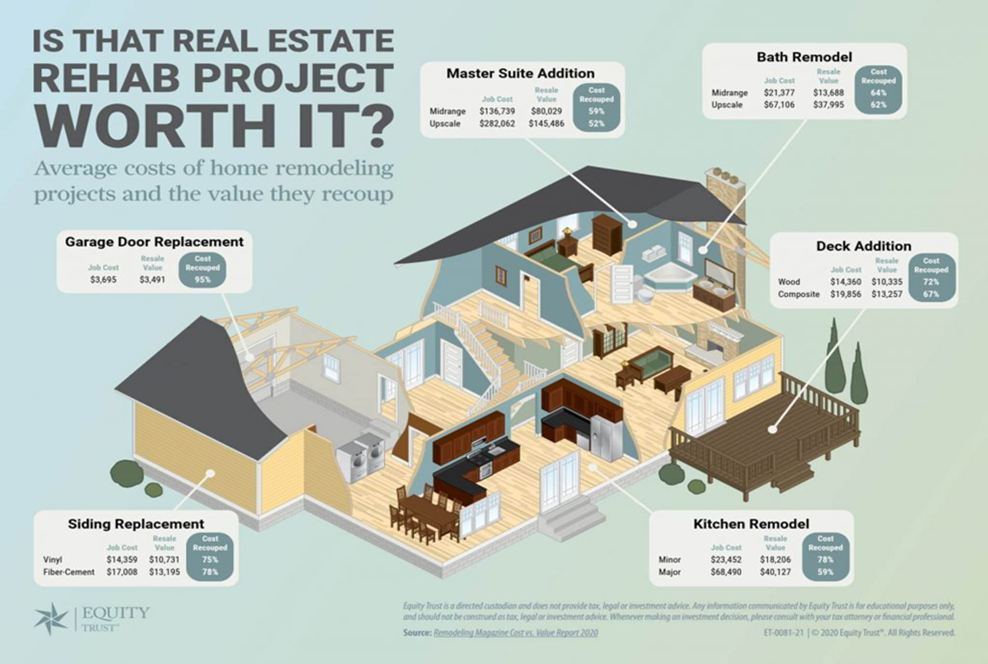

- 🔧 Fix-and-flip or value-add

- 🏚️ Heavy rehab projects

- 🛠️ Multifamily or commercial repositioning

👤 Best For Borrowers Who:

- Need financing for both acquisition + renovation

- Want higher leverage on construction costs

- Are using private lenders, bridge lenders, or non-bank programs

📈 Typical LTC Ranges:

- Bridge Loans: 80–90%

- Construction Loans: 75–90%

Value-Add Projects: 80–90%

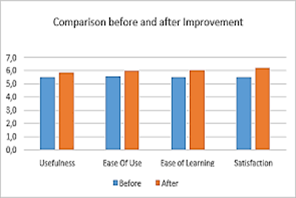

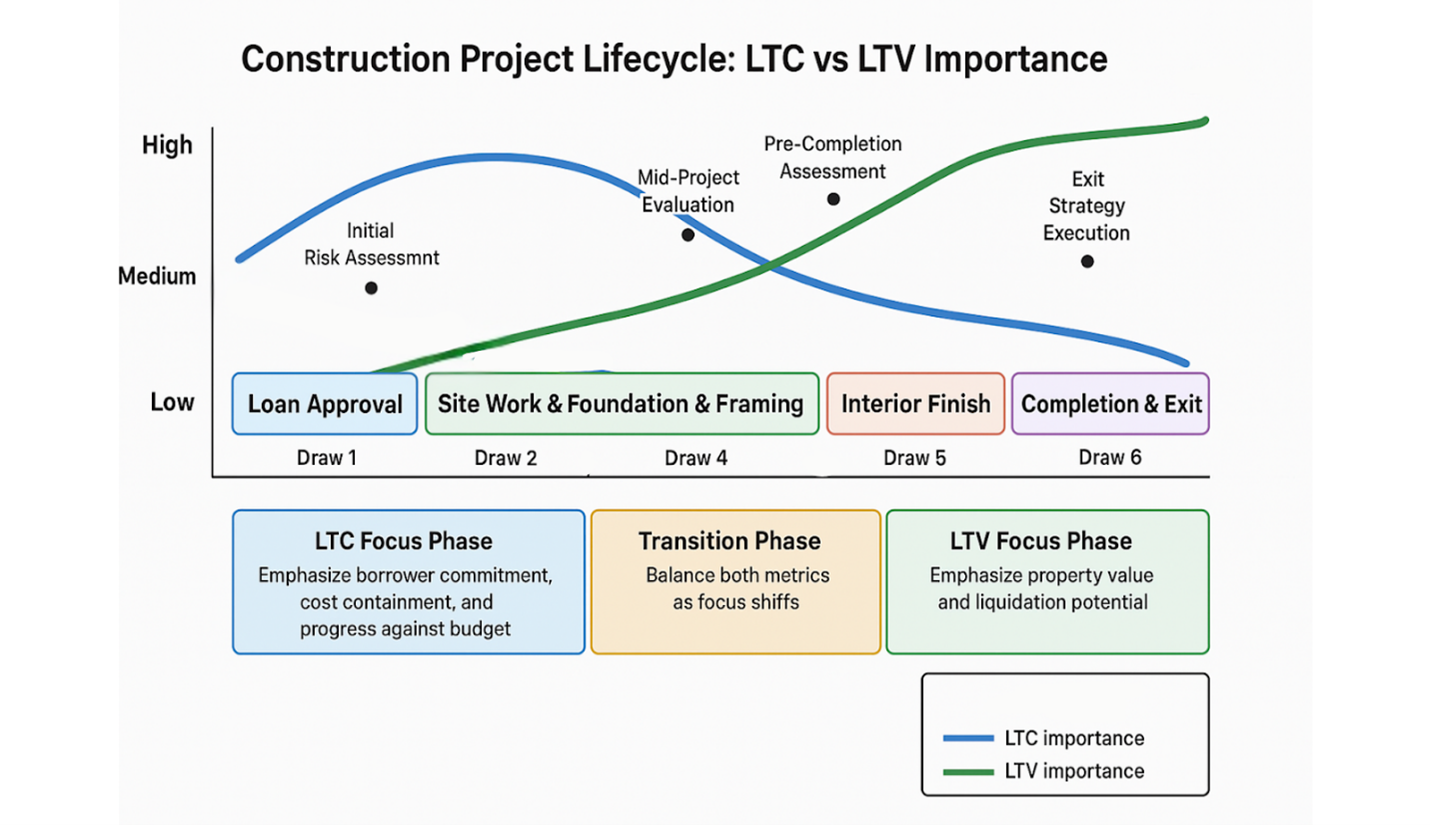

🔄 How LTC Converts into LTV (After Completion)

When the project is finished, lenders stop using LTC and switch to LTV, based on the new market value.

✔️ Before Construction → Evaluated Using LTC

Loan is based on total project cost.

✔️ After Stabilization → Evaluated Using LTV

Loan is based on the post-construction appraised value.

📊 Graphic: LTC to LTV Conversion Example

Project Cost: $1,000,000

Loan Based on LTC: 85% =

$850,000

After-Repair Value:

$1,300,000

Refinance Based on LTV (75%):

$975,000

Meaning:

🏦 You can refinance, lower payments, or even pull-out equity — because LTV is higher than the original LTC amount.

⚖️ LTV vs. LTC — Side-by-Side Comparison

When to Use LTV

- 🏠 Buying existing property

- 🏦 Refinancing

- 💵 Accessing equity

- ✔️ Long-term loans

When to Use LTC

- 🏗️ New construction

- 🔨 Rehab or flip

- 👷 Value-add projects

- ✔️ Bridge or private loans

🚀 How Plethora Financial Solutions Helps

✔️ If You Need LTV-Based Financing:

- Competitive commercial rates

- Fast closing timelines

- Refinance or acquisition

✔️ If You Need LTC-Based Financing:

- Up to 90% LTC available

- Financing for rehab + construction

- Bridge loans with fast underwriting

✔️ We Also Offer:

- DSCR Loans

- Private & Hard Money

- Alternative funding programs

- Customized real estate funding strategies

📞 Contact Plethora Financial Solutions Today

Let our lending experts structure your financing for maximum leverage.

📧

GChang@PlethoraFinancialSolutions.com

📞

832-521-8887

🌐

www.PlethoraFinancialSolutions.com

Send us a message

For immediate assistance and personalized conversation, our experienced advisors are just a phone call away.

832-521-8887

Cypress, TX

- Mon - Fri

- -

- Sat - Sun

- Closed

Have a specific question or want to request a free,

no-obligation consultation? Fill out the form below, and one of our dedicated financial professionals will be in touch shortly.

Contact Us

Thank You for Your Message!

Thank you for taking the first step towards empowering your business with Plethora Financial Solutions! Your message has been successfully received.

Please try again later.