Beyond SBA: Keep Your Business Moving with Plethora Financial Solutions

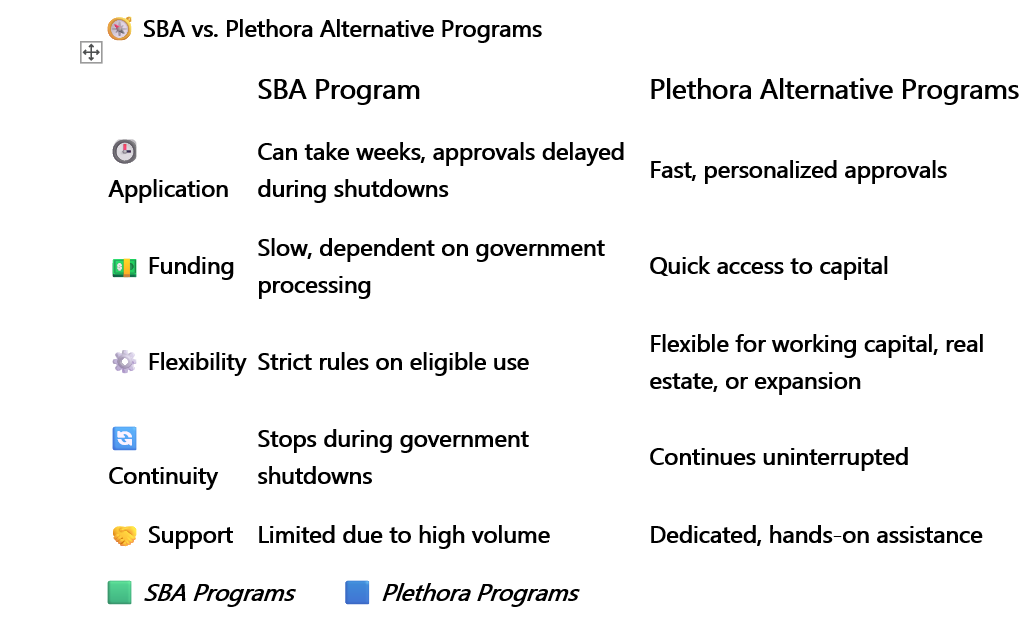

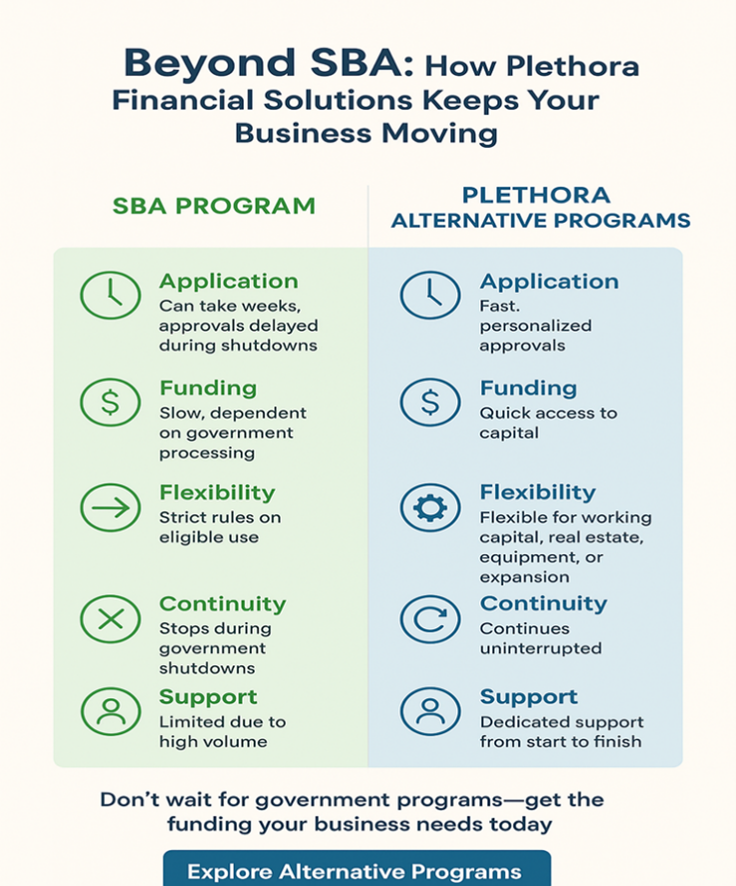

💡 When SBA Programs Stall, Your Business Doesn’t Have To

Even when government programs pause, Plethora Financial Solutions keeps funding flowing. Our alternative programs mirror the accessibility of SBA lending—but without the red tape or shutdown delays.

💼 Our Core Funding Solutions

💰 Private Lending Solutions

Quick funding for working capital, equipment, or real estate — so you never lose momentum.

🌉 Bridge Loans

Short-term funding to fill financial gaps and keep operations running smoothly.

🏢 Commercial Real Estate Loans

Finance property purchases, renovations, or expansions without SBA delays.

⚙️ Equipment & Working Capital Loans

Flexible repayment options designed to align with your business cash flow.

🚀 Why Businesses Choose Plethora

✅ Faster approvals than traditional SBA timelines

✅ Personalized support from start to finish

✅ Flexible solutions for every business need

✅ Stable funding — even during government shutdowns

📞 Let’s Keep Your Business Funded — Even During a Shutdown

Tell us what you’re trying to finance — real estate, expansion, payroll, or equipment — and we’ll help you move forward today.

📧 Email: GChang@PlethoraFinancialSolutions.com

📞 Phone: 832-521-8887

🌐 Website:

www.PlethoraFinancialSolutions.com

Plethora Financial Solutions

Funding Growth. Empowering Businesses.

Send us a message

For immediate assistance and personalized conversation, our experienced advisors are just a phone call away.

832-521-8887

Cypress, TX

- Mon - Fri

- -

- Sat - Sun

- Closed

Have a specific question or want to request a free,

no-obligation consultation? Fill out the form below, and one of our dedicated financial professionals will be in touch shortly.

Contact Us

Thank You for Your Message!

Thank you for taking the first step towards empowering your business with Plethora Financial Solutions! Your message has been successfully received.

Please try again later.