Bridge Loan vs. Gap Loan: What’s the Difference and Which One Do You Need?

Bridge Loan vs. Gap Loan: What’s the Difference and Which One Do You Need?

In commercial finance, the terms Bridge Loan and Gap Loan are often used interchangeably — but they are not the same. For business owners, real estate investors, or developers choosing the right structure can save time, prevent delays, and unlock capital when traditional lending slows down.

Plethora Financial Solutions specializes in fast, alternative funding. Below is a clear breakdown to help you decide which option fits your situation.

What Is a Bridge Loan?

A Bridge Loan is short-term financing that covers a gap between now and a future, predictable financial event — usually the sale of a property, a refinance, or long-term loan approval.

Key Features

- Short-term: 6–24 months

- Collateral-backed (typically real estate)

- Fast approvals and funding

- Higher rates compared to bank loans — but much faster

- Ideal when you know your exit strategy

Common Use Cases

- Buying a new commercial property before selling an existing one

- Quick-close real estate acquisitions

- Repositioning or renovating property prior to refinancing

- Taking advantage of time-sensitive investment opportunities

Who Should Use It:

Real estate investors, developers, or business owners who need speed, certainty, and temporary capital to move on an opportunity.

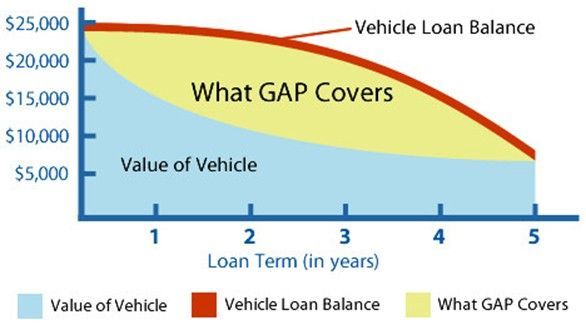

What Is a Gap Loan?

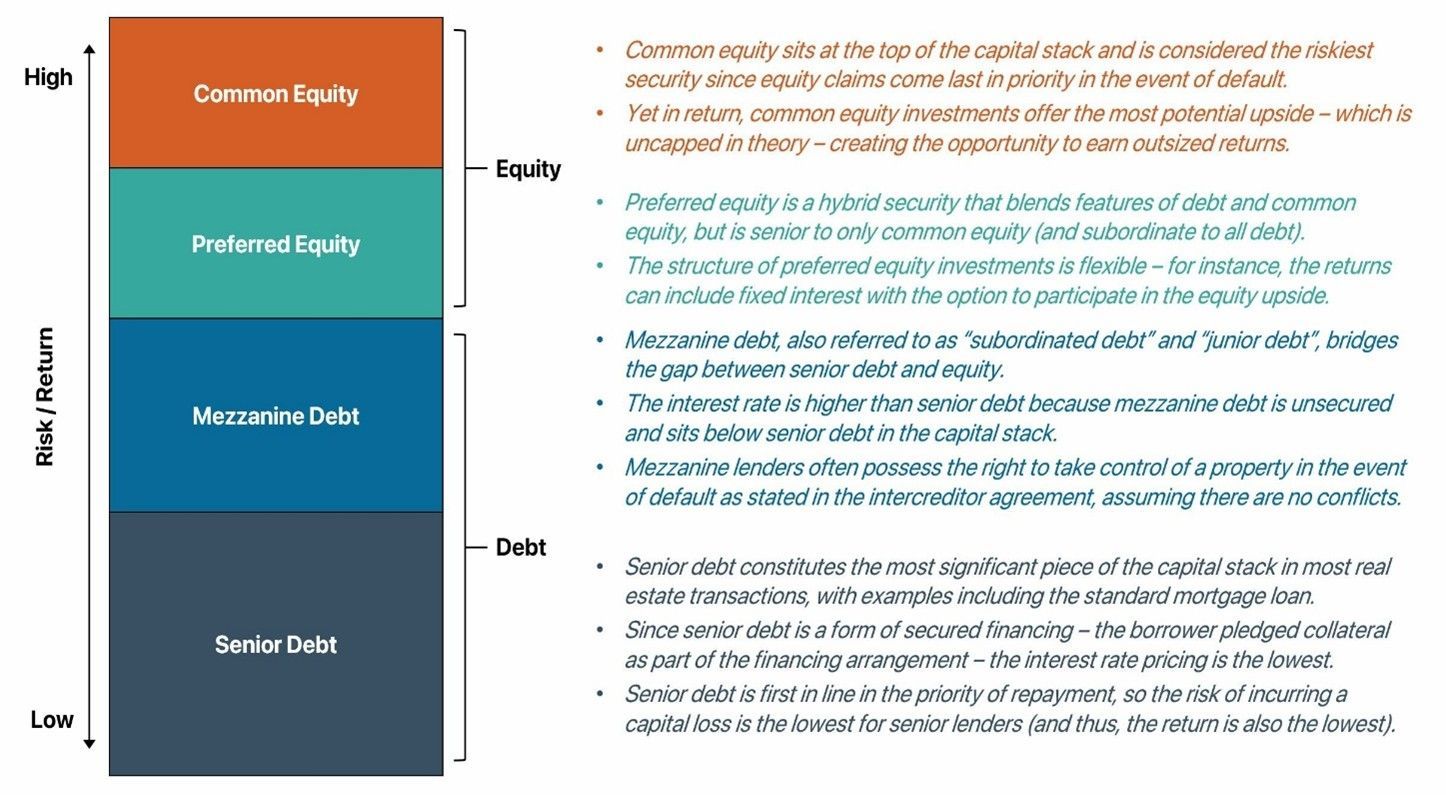

A Gap Loan (often called gap financing or mezzanine capital) is designed to fill a financial shortfall when your primary funding source doesn’t fully cover project costs.

Think of it as the “plug” in your capital stack.

Key Features

- Used alongside another loan (SBA, construction, CRE loan, bridge loan, etc.)

- Shorter-term than bridge loans — often 3–12 months

- Covers the “missing amount” needed to close or continue a project

- Higher-risk and typically more flexible

Common Use Cases

- Construction projects that run over budget

- Borrowers who are short on down payment

- SBA or traditional loans that leave a funding gap

- Investors who need additional cash to meet lender requirements

A Gap Loan (often called gap financing or mezzanine capital) is designed to fill a financial shortfall when your primary funding source doesn’t fully cover project costs.

Think of it as the “plug” in your capital stack.

Key Features

- Used alongside another loan (SBA, construction, CRE loan, bridge loan, etc.)

- Shorter-term than bridge loans — often 3–12 months

- Covers the “missing amount” needed to close or continue a project

- Higher-risk and typically more flexible

Common Use Cases

- Construction projects that run over budget

- Borrowers who are short on down payment

- SBA or traditional loans that leave a funding gap

- Investors who need additional cash to meet lender requirements

Who Should Use It:

Developers, business buyers, or investors who have

most of their financing in place but need additional capital to complete the deal.

Bridge Loan vs. Gap Loan: Side-by-Side Comparison

Which One Do YOU Need?

Choose a Bridge Loan If…

- You found a strong investment but need to close quickly

- You’re waiting on a property sale or long-term loan approval

- You want short-term liquidity without disrupting long-term plans

- You need acquisition-ready funds today

Choose a Gap Loan If…

- You’re short on down payment or working capital

- Your SBA or bank loan doesn’t cover the full project cost

- Construction expenses increased unexpectedly

- You have financing — but need a little extra to get across the finish line

How Plethora Financial Solutions Helps

With traditional lenders tightening rules and slowing down approvals, Plethora Financial Solutions offers fast, flexible Bridge and Gap Financing with:

- Quick decisions

- Tailored underwriting

- No government delays

- Funding for real estate, business acquisition, working capital, and expansion

Ready to Secure Fast Capital?

📧

GChang@PlethoraFinancialSolutions.com

📞

832-521-8887

🌐

www.PlethoraFinancialSolutions.com

Send us a message

For immediate assistance and personalized conversation, our experienced advisors are just a phone call away.

832-521-8887

Cypress, TX

- Mon - Fri

- -

- Sat - Sun

- Closed

Have a specific question or want to request a free,

no-obligation consultation? Fill out the form below, and one of our dedicated financial professionals will be in touch shortly.

Contact Us

Thank You for Your Message!

Thank you for taking the first step towards empowering your business with Plethora Financial Solutions! Your message has been successfully received.

Please try again later.