Overcoming Tariff Pressures

Understanding the Challenge: Tariffs and Supply Chain Pressures

Tariffs—essentially taxes on imports—have become one of the most disruptive forces in today’s global economy. While designed to protect domestic industries, they often create ripple effects that complicate supply chain stability and strain business liquidity.

Common impacts of tariffs include:

- Higher Input Costs: Raw materials and finished goods become more expensive.

- Margin Pressure: Companies either raise prices (risking competitiveness) or absorb the cost (reducing profitability).

- Supply Chain Shifts: Businesses are forced to re-source materials to avoid tariff-heavy regions, often at higher costs.

- Cash Flow Strain: Importers must pay tariffs upfront at customs, locking up valuable working capital.

- Volatility & Uncertainty: Longer lead times, renegotiations, and shipment delays disrupt predictability.

The result? Businesses face both financial stress and operational risk—a one-two punch that can threaten growth if left unchecked.

The Solution: AP Factoring for Resilient Supply Chains

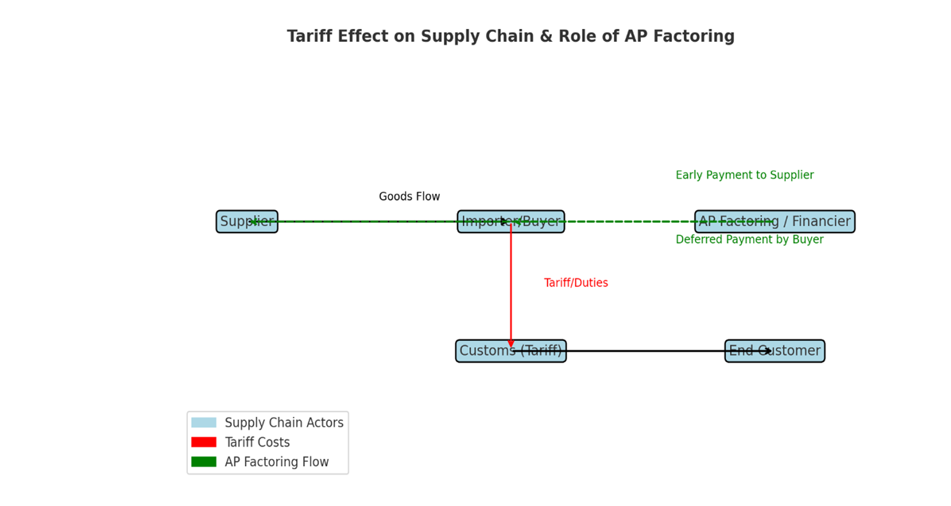

This is where AP factoring (also called reverse factoring or supply chain financing) offers a smart, stabilizing solution.

By working with a financing partner like Plethora Financial Solutions, companies can extend payment terms while ensuring suppliers are paid promptly.

Key benefits:

- Improved Liquidity: Unlock cash tied up in tariffs and inventory costs.

- Supplier Stability: Vendors get paid immediately, protecting the flow of goods.

- Negotiation Power: Confident suppliers are more likely to offer favorable pricing or terms.

- Reduced Disruption Risk: On-time supplier payments prevent supply chain bottlenecks.

- Flexibility to Manage Tariff Costs: Extra cash flow can cover duties, diversify sourcing, or strengthen inventory positions.

In short: AP factoring transforms tariff stress into a manageable, strategic challenge.

Real-World Example

Imagine a U.S. importer hit with a sudden 15% tariff increase:

- Instead of draining reserves to cover both duties and supplier payments, they use Plethora’s AP factoring.

- Suppliers receive immediate payment.

- The importer gains 60–90 extra days on payment terms.

- Cash flow stays balanced until sales revenue offsets the tariff costs.

Result: What could have been a cash-flow crisis becomes a controlled adjustment.

Why Choose Plethora Financial Solutions?

At Plethora, we go beyond financing—we help companies build resilience.

With our AP factoring solutions, you can:

✔ Navigate tariff shocks without panic.

✔ Protect and stabilize cash flow.

✔ Strengthen supplier partnerships.

✔ Keep supply chains moving under global pressures.

When money flows with intention, it creates strength—not strain.

Send us a message

For immediate assistance and personalized conversation, our experienced advisors are just a phone call away.

832-521-8887

Cypress, TX

- Mon - Fri

- -

- Sat - Sun

- Closed

Have a specific question or want to request a free,

no-obligation consultation? Fill out the form below, and one of our dedicated financial professionals will be in touch shortly.

Contact Us

Thank You for Your Message!

Thank you for taking the first step towards empowering your business with Plethora Financial Solutions! Your message has been successfully received.

Please try again later.